Table of Contents

What Candlesticks Really Tell Us About Fear and Hope

If you’ve ever felt like the market is a strange mix of logic and emotion, you’re not alone. As traders, we all try to decode the charts and indicators, but in truth, what we’re really trying to understand is sentiment—the heartbeat of the market.

One of the most understated, yet revealing, candlestick patterns is the Bullish Harami. It’s not loud or dramatic like the Bullish Engulfing or Hammer. In fact, if you weren’t paying attention, you might miss it. But this small, “pregnant-looking” pattern has saved me more than once from making impulsive decisions in a downturn. And that’s what this article is about: understanding the deeper meaning behind this pattern and how it reflects shifting sentiment—something every trader needs to grasp.

Understanding The Bullish Harami Pattern

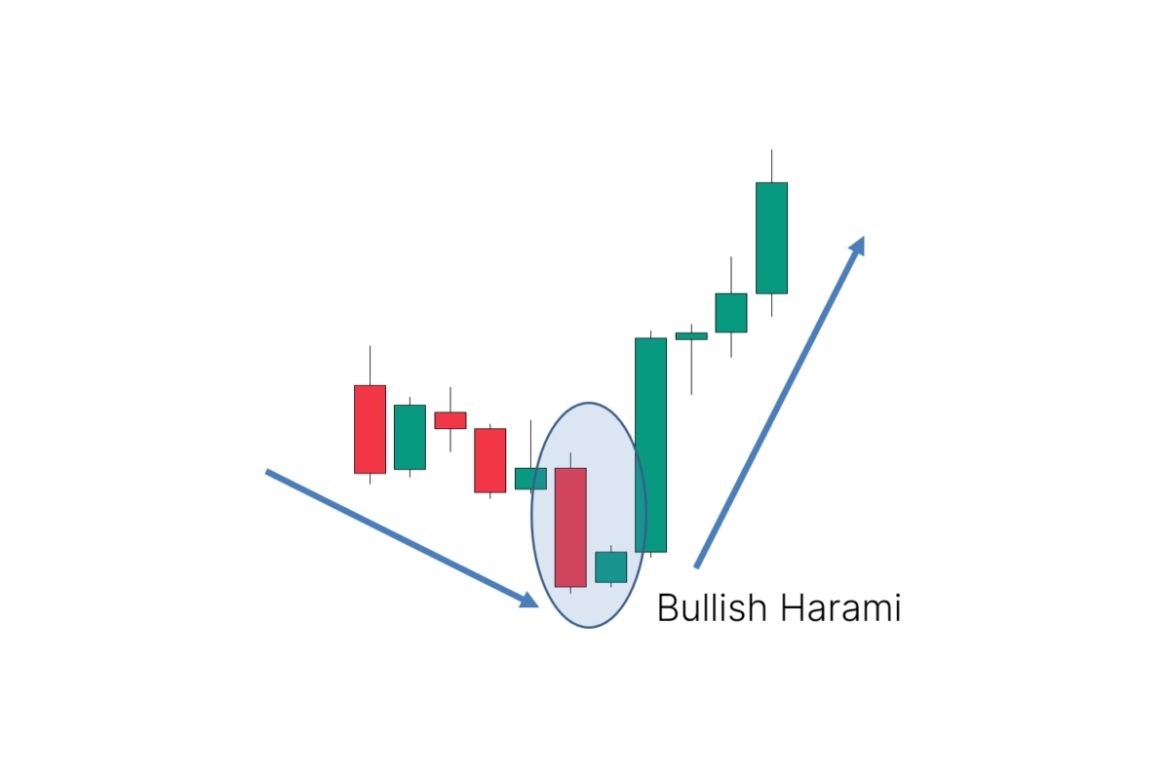

At its core, the Bullish Harami is a two-candle formation that appears after a downtrend. The first candle is a large bearish (red) candlestick, representing strong selling pressure. The second candle is a small bullish (green) candlestick, and it forms entirely within the body of the previous one—almost like it’s “nested” inside.

The visual contrast between the two candles is what makes this pattern interesting. It reflects hesitation in the downward momentum. Sellers dominated one day, but the very next session, the price barely moved and even closed slightly higher. It’s subtle—but in markets, subtlety can be powerful.

This isn’t a loud scream of reversal. It’s a quiet suggestion: “Maybe the worst is over.”

The Emotional Shift Hidden Inside The Chart

Let’s talk about what’s really happening behind the candles.

Imagine a stock that’s been on a steady decline for a week. Investor sentiment is pessimistic. Everyone’s selling. Then one day, instead of another deep red candle, something different happens. The market opens lower, but it doesn’t drop further. It holds steady. In fact, it starts to move slightly upward by the close.

That’s the Bullish Harami revealing itself. What you’re witnessing is fear giving way to doubt. Sellers are running out of steam. Buyers are stepping in—not boldly, but cautiously. This tug-of-war shows a potential shift in control. The chart becomes a mirror of the crowd’s psychology: hesitation, uncertainty, and the first signs of hope.

I’ve personally spotted this pattern after long, grinding declines. It never felt like a strong reversal in the moment—but more like the calm after the storm. And when I trusted it with confirmation, it often led to some of my most rewarding trades.

When the Bullish Harami Matters Most

Like all patterns, context matters. A Bullish Harami on a random Tuesday during a choppy sideways market might not mean much. But after a long sell-off, near a historical support zone, or following a major economic news event? Now that’s when it shines.

It’s especially powerful when combined with signals like decreasing volume (which hints at exhaustion in selling) or indicators like RSI showing bullish divergence. I’ve also found that the pattern tends to appear near the end of corrective waves in Elliott Wave structures—particularly during Wave C, when markets are oversold, and pessimism peaks.

That’s where the pattern becomes more than just technical—it becomes intuitive. You don’t just see it, you feel it. And that instinct, developed over time and experience, is where great traders separate themselves from the good ones.

A Personal Story: How This Tiny Pattern Saved My Week

I remember trading during a particularly volatile period in the energy sector. One stock, let’s call it “PetroCore,” had been falling for ten straight days. I had bought the dip way too early and watched my position slide further into the red.

It was tempting to just cut my losses and move on.

Then, something caught my eye. For the first time in two weeks, the price didn’t collapse at the open. Instead, it dipped a little, held its ground, and closed with a tiny green candle—tucked perfectly inside the previous day’s red candle.

I was skeptical. But I remembered this pattern. I waited another day. The next candle closed higher. Volume was light, but the selling pressure was clearly drying up.

I didn’t double down, but I held. Over the next five sessions, the stock climbed 15%. That small Harami turned out to be the first sign of a shift—a whisper of optimism in a crowd that had been shouting panic.

How to Actually Trade It—Without Making Rookie Mistakes

Let’s be real: candlestick patterns aren’t magic. They’re tools, not crystal balls. The Bullish Harami should never be traded in isolation. Confirmation is key.

If you’re thinking of acting on it, wait for the next candle to break above the high of the small green Harami candle. That’s your trigger that buyers are stepping in. Place your stop-loss just below the low of the red candle—it’s your safety net if sentiment hasn’t truly shifted.

This pattern works well for swing traders and can even be adapted for intraday strategies. I’ve found it particularly effective when trading sectors under pressure—where oversold conditions give way to short-covering rallies.

Conclusion

The Bullish Harami teaches us to slow down. In a world of alerts, indicators, and rapid-fire decisions, this pattern is a reminder to pause and observe.

It’s not flashy. It won’t always lead to big wins. But it speaks volumes about the mood of the market. It tells us when fear is losing its grip and when buyers are cautiously returning.

I’ve seen this pattern over and over again in real-world markets, and its subtlety has taught me more about timing and sentiment than any indicator ever could.

If you’re serious about mastering trading psychology and want tools that reflect actual market behavior—not just theory—platforms like Alchemy Markets offer the flexibility and depth to explore patterns like the Harami, support zones, and broader sentiment indicators.

In the end, success in trading isn’t about chasing momentum. It’s about understanding when and why things are changing.

And the Bullish Harami? It’s a quiet but powerful signal that sometimes change begins with a whisper.

Frequently Asked Questions (FAQ)

What Makes The Bullish Harami Different From Other Patterns?

Unlike the Bullish Engulfing, which shows strong reversal force, the Bullish Harami is more about a pause and a potential pivot. It reflects hesitation in the downtrend, rather than an aggressive shift in control.

Can Beginners Use This Pattern Effectively?

Yes, but it requires patience and a willingness to wait for confirmation. Don’t jump in just because you spot the shape. Look at the bigger picture—trend, support zones, and volume.

Is The Bullish Harami Part Of The Elliott Wave Course?

Not officially, but it often appears during corrective waves, especially at the tail end of Wave C or Wave 2 pullbacks. If you’re taking an Elliott Wave course, you’ll notice these candlestick clues lining up with wave-based reversals more often than not.

Does It Work Across All Timeframes?

It does, but its reliability improves on higher timeframes, like daily or weekly charts. On lower timeframes, the noise and volatility can lead to more false signals, so you’ll need to be extra cautious.